11 Dec 2024

Tired Earth

By The Editorial Board

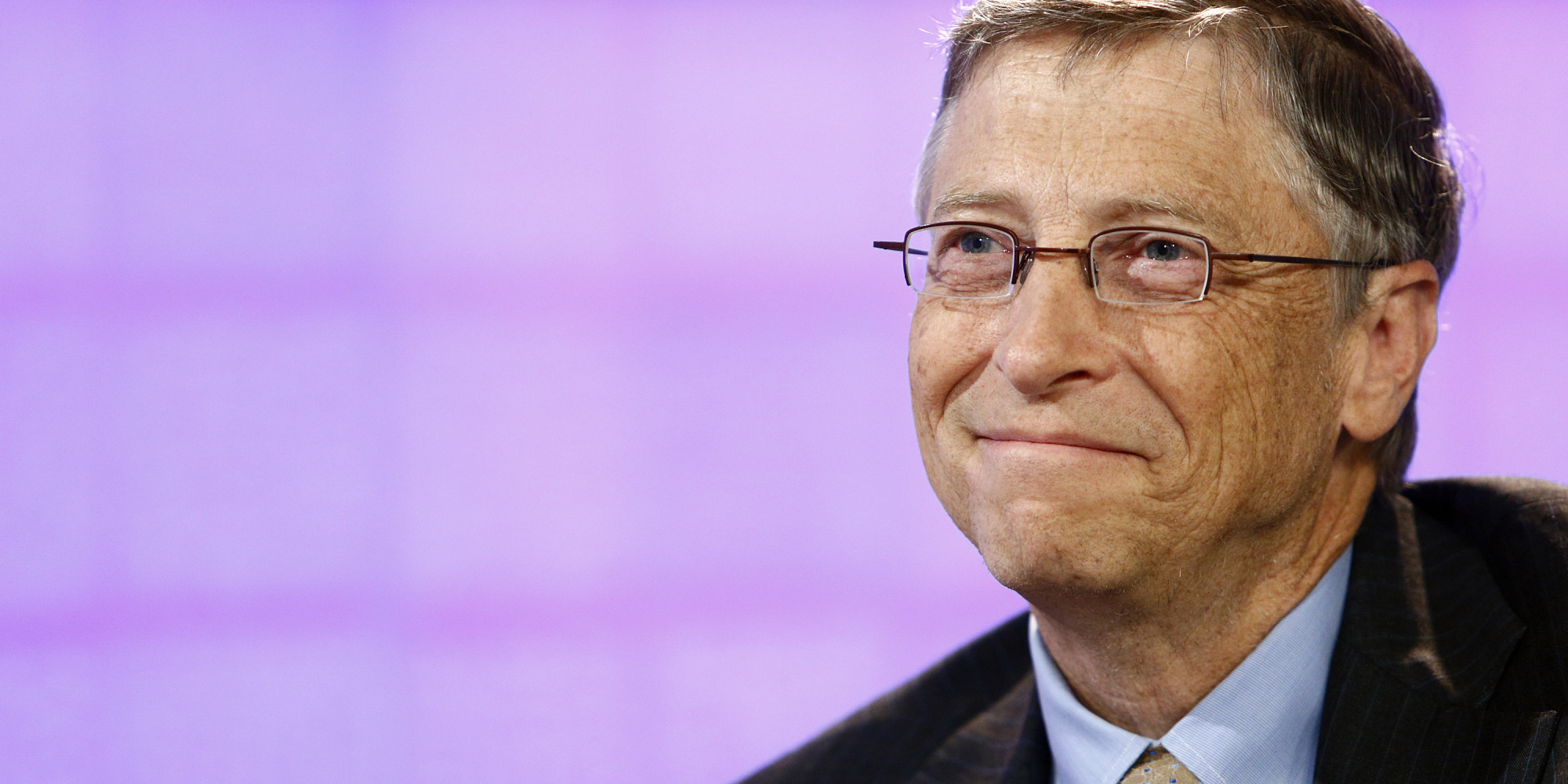

Gates spoke with Recode on Monday, shortly after announcing his $1 billion clean energy fund

Bill Gates is an optimist. That said, he believes getting a desired outcome means taking on significant risk, making a big investment and having a long-term view.

That is the approach Gates took at Microsoft by choosing to license, rather than sell, his computer operating system to IBM.

And it’s the same approach Gates is using in his latest project: The $1 billion Breakthrough Energy Ventures fund announced on Monday. The effort, which also has funds from Alibaba’s Jack Ma and venture capitalists Vinod Khosla and John Doerr, aims to fund only energy companies that show the potential to make a meaningful difference in climate change.

“If you can make electrons cheaper than someone, that is one of the biggest markets in the world,” Gates told Recode on Monday.

And he’s not going to let little obstacles, like the election of Donald Trump as U.S. president, get in his way. Instead, Gates is trying to pitch Trump on the economic benefits of being a leader in clean energy, regardless of whether Trump believes in climate change.

“Research has pretty big payoffs, whether it is jobs or leadership,” Gate said in the interview. “Even if you just put a security lens on it, energy is pretty important.”

Here’s an edited transcript of Gates’ conversation with Recode’s Ina Fried:

How concerning is it to you that as you are doing this, we have a president-elect who says he isn’t convinced climate change is real?

Gates: It will be interesting to see what we get out of this administration. I’m hopeful that some of the innovation things, including in energy, but in basic science (also), that we can even strengthen the bipartisan support.

Research has pretty big payoffs, whether it is jobs or leadership. Even if you just put a security lens on it, energy is pretty important. I hope people appreciate that, in terms of scientific understanding, we are in a pretty strong position. When you have an opportunity like that it is a good time to invest in it.

You have to look at the energy market broadly, and we have to make the case to the Congress about investing in innovation, and the executive branch has to see it as a good deal.

But, just to be clear, that’s the government piece. Breakthrough Energy Ventures, no matter what happens to the energy R&D budget, we are going to go out and find the ideas that are out there. It’s just more favorable if governments as a whole are putting more into the basic research level.

When you spoke to President-elect Trump, did you encourage him to take energy issues seriously, or what was your advice to him?

It wasn’t a super-long call, and I am sure I will get a chance to talk to him more in the future. The theme of the call was about innovation and innovation in helping things like being able to stop epidemics or finishing polio eradication or innovation in educational-related software. I did speak specifically about energy.

It wasn’t a long enough call to get a clear sense. Obviously there will be a lot of key appointees like secretary of energy, and the Congress will be still a major factor when you look at this stuff at a budgetary level.

One of the benefits about this investment fund is this isn’t about one country or one administration. But how important is the tone that government sets when it makes clean energy a priority or not a priority?

Take like India — if you say there is some huge premium for clean energy, that’s a huge dilemma for them because getting energy out so that people have air conditioning and lights and the basic stuff we take for granted, it actually not only improves lives, but saves lives. The goal has got to be, even though there may be some bootstrap period, has got to be to have this clean, reliable energy that is actually lower cost. Subsidization has helped accelerate wind and solar.

One of the things you have talked about is that the limiting factor might not actually be the billion-dollars-plus that you have set aside to invest but rather the number of companies that can meet the criteria you have set out, which is that it has to make a meaningful difference in climate change. What areas are promising as far as investments for the next year or two of the fund?

I used solar fuels as an example, both because I am excited by it and because it hasn’t received nearly the same visibility. And because, if it works economically and it is a long ways from showing that it can do that, it actually solves the storage problem, which is such a huge problem.

We hope to find a lot of things like solar fuels. Vinod (Khosla) thinks geothermal might be able to play a bigger role than just in the unusual places where the high heat is near the surface of the earth. That’s absolutely worth looking into.

Nuclear fusion, there’s actually quite a few companies out there. At this stage I don’t know if any of them given 20 years can really do something economic. I’m not saying for sure there is something out there.

I’ve been in nuclear fission with TerraPower. We’ve got a couple reactor projects, one of which we will be partnered with companies in China. The other one, which is earlier stage, got a big Department of Energy grant, which is a three-way partnership between the U.S. government and the Southern Company, the big utility company down in the southeast, and TerraPower. That’s actually a very unusual design called a molten chloride fast reactor. It’s in the general class of salt reactors the U.S. has played around with. That’s where the economics and safety could be dramatically better than even the latest so-called third-generation reactors.

And I hope I get surprised by some things that come in.

Are there any things you think we have learned from the last generation of clean tech investments that doesn’t work well?

Certainly having a five-to-10-year time frame is constraining. Not bringing the strategic investors in at a very early stage, sometimes you go off in a direction that doesn’t fit the tight constraints. Really having the next tier of capital ready, which is why we are working with a variety of institutions so that when the stuff needs to scale up.

There have been a lot of successes. Vinod sold one called Climate Corp., which is about smart agriculture. He sold that to Monsanto. He had a positive return on his clean tech work, not as much as he had in some of his other tech funds, but still it was very impressive. So we have the benefit of all of the work he and others like John Doerr did.

It sounded from the other investors talking that, just from a pure economic standpoint, never mind the benefit to civilization, they see this as a good investment strategy. How important is that piece?

John Arnold (another BEV investor), he’s an energy expert. His point is a very good one.

If you can make electrons cheaper than someone, that is one of the biggest markets in the world. It means there aren’t a lot of niche markets where in software you can start out being the best for a few customers and then broaden that piece.

If your electrons cost extra, there aren’t a lot of niche plays in that. You end up with a lot of all-or-nothing things. They are going to be absolutely gigantic or not get there. It is daunting, but with a few breakthroughs, we can make money for the investors. They are being asked to be a bit more patient than normal because of the length of the fund (Its plan is to see returns over a 20-year time frame.) They are all people that care about the issue of a clean energy system.

recode.net

Comment